A recent survey from McKinsey, a global consulting firm, claims frugal is the new normal. The survey found four in ten Americans trimmed their spending in the past 12 months, while 55% are searching for ways to cut back.

When it comes to entertainment, particularly sports, people are not pinching pennies. According to the 2014 edition of the PwC Sports Outlook, the market is expected to grow by $7.2 million from 2015 to 2018.

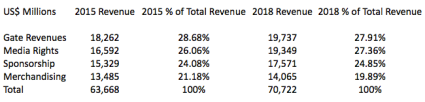

There are four key segments within the North American revenue stream: gate receipts, media rights, sponsorship, and merchandising.

Media rights are projected to continue growing at the highest rate: 26.06% of total revenue in 2015 to 27.36% in 2018. Sponsorship will also see an increase from 24.08% to 24.85%, while the shares of gates revenues and merchandise are expected to fall.

Notice the give-and-take relationship between gate revenues (-.77%) and media rights (+1.3%) from 2015 to 2018. Fans are not going to just give up and stop consuming sports. They will either watch in person or on a broadcast.

Disposable incomes are limited. Organizations are constantly struggling to find ways to sell tickets and fill stadiums/arenas. Consumers want more of an experience than just watching a ball get passed around while they sit and get a sunburn or frostbite.

The Tennessee Titans heard the gripes, so Comcast is installing WiFi at LP Field before the upcoming season. AT&T installed two new 4G LTE antennas in 2012 near the Bridgestone Arena to accommodate an increase in mobile use. The Jacksonville Jaguars recently put up cabanas with a fully serviced, premium tailgate/seating experience. EverBank Field also offers two swimming pools where fans can watch games. The Tampa Bay Buccaneers have a life-size pirate ship at Raymond James Stadium. Other facilities are making changes to their seating, concessions, and parking lots.

As fans decide to stay home and watch a game, leagues realize media rights will increase $2.6 million in 2018. The National Football League just renewed its contract with CBS to broadcast eight games on Thursday nights for more than $275-$300 million. Several current deals are expected to expire by 2018, and the media companies already know it’ll be costly to renew. Organizations are also striking up conversations about online streaming, OnDemand, and mobile apps.

Keep in mind that nothing beats the live atmosphere on game day, which explains why gate revenues still make up the biggest piece of the pie in 2015 and 2018.

Sponsorship is dependent on the economy (+$2.2 million and +.77%). PwC lowered its five-year growth rate from six-percent per year to just under five-percent per year. The reason:

A slower roll-out and slightly less optimistic outlook for the potential net impact of new sponsorship inventory resulting from digital media platforms, uniform rights, and in-venue signage/naming rights, as well as further brand category rights segmentation.”

Local facility naming rights will continue to increase revenue as a lot of contracts are expected to expire soon.

Merchandise will see very little growth in terms of dollar amount (+$580 million) and the biggest drop in percentage (-1.29%). If someone has a team jersey or hat, they probably won’t buy another one. One way organizations can increase this segment is by changing logos or color schemes. There is also a need to focus more on women, children, and electronics. Dooney & Bourke, a leading handbag company, is now offering Major League Baseball and collegiate products.